Atlanta, GA

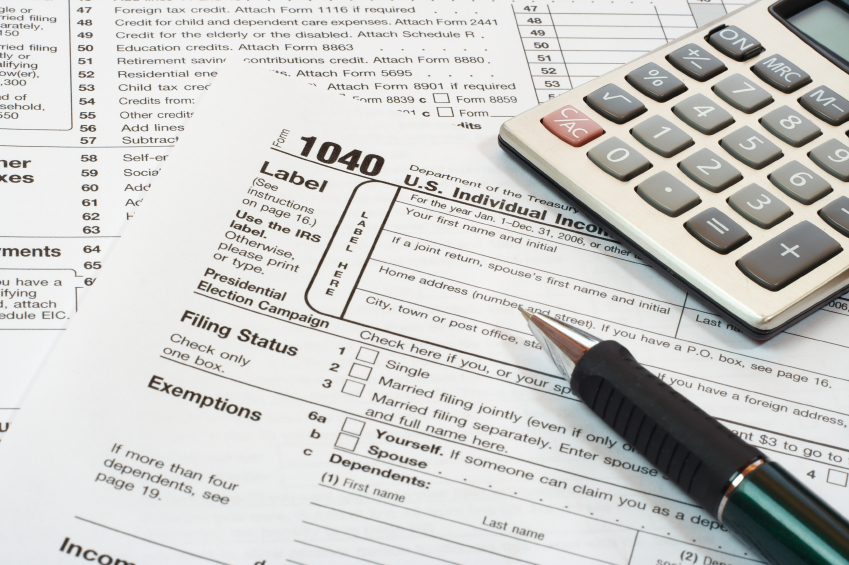

ERC Tax Service is located in the heart of Atlanta and provides an array of tax planning, preparation and accounting services. Because our firm is relatively small, our clients benefit by getting personalized, and quality service that is beyond comparison.

ERC TAX is exclusively focused on understanding our clients’ needs by closely reviewing their tax opportunities and from our analysis we develop comprehensive tax package.

We prefer to take a proactive vs. reactive approach to tax services. By keeping current on new tax laws and legislation, we are in a position to identify key tax planning opportunities that minimize both your current and future tax liabilities. We provide our individual and business clients with the taxation expertise and knowledge that they deserve throughout the year.